The best rates, even better service.

We are a family owned mortgage lender in Memphis, Tennessee built to provide our clients lower mortgage rates and five-star service.

PRODUCTS

Range of mortgage products to fit your needs.

LOW RATES

Rates below the national average.

OUR PROCESS

A human experience with online ease.

COMMUNICATION

Responsive, straightforward communication.

You deserve lower mortgage rates.

6.170%

Today's National Average

30 Year Fixed Conventional

Today's national average for a 30 year fixed Conventional rate per Mortgage News Daily.

5.875%

Today's Rate (5.903% APR)

30 Year Fixed Conventional

Today's 30 year fixed Conventional rate from Local Mortgage.

.295%

Today's Rate Savings

Lock in a lower rate today

Our customer's rate savings as compared to the national average.

$23,512

Life of Loan Interest Savings

This can be your savings

The life of loan interest savings for a $344,000 loan amount.

You deserve the best mortgage company.

We have an unwavering commitment to our clients. Read a few of our 200+ reviews on Google, they will tell you better than we can! You can can count on our commitment to being available when you need us, answering your questions, and handling your loan with the care it deserves. Our company is built around owners and stakeholders, rather than employees. Quite frankly, your satisfaction means more to us.

Our mission is to help you save. You work hard to afford your home, don't pay more than necessary. We monitor our rates everyday to make sure that we are giving you the best mortgage at the lowest rate possible. Since our company is built around owners, we have eliminated high sales commissions which results in lower rates for you.

Our family has over 50+ years of combined experience helping families buy homes. We have closed thousands of loans for people just like you, giving us the experience and expertise to close your loan quickly and efficiently.

Become our customer and we will make you a fan.

"I would give 6 stars if I could"

I would give 6 stars if I could. From start to finish Travis and Derek guided me through the mortgage process. Answered my questions I had late at night and on the weekends due to my crazy schedule. Please use Local Mortgage for your next home purchase. They are AWESOME!!!

"eager to help any way they could"

My experience working with Travis and Derek was outstanding. They kept me informed at every point in the process and were eager to help any way they could. I would recommend this group to anyone!

"wonderful and gracious to me during the entire process"

Chase was wonderful and gracious to me during the entire process. Any questions I had he answered in a timely manner. He helped me with whatever I needed to ensure a smooth process. I would definitely recommend Travis and his team at Local Mortgage.

Our Mortgage Products

We offer the best mortgage products for your home purchase or refinance. No matter which product you need, you will always get the best mortgage rate.

Our Approved States

We are located in the heart of Memphis, Tennessee and proudly serve our hometown of Memphis and the surrounding areas. Being a local mortgage lender, we are able to provide the best mortgage at the lowest rate to the communities and neighborhoods where we work and live.

By investing in the best technology and committing to the highest levels of service, we are able to deliver our hometown service across a wider geographic footprint with no sacrifices. Home buyers and homeowners in the states listed here can also get the best rate and experience our five star service.

Colorado

Florida

Georgia

Mississippi

Tennessee

-min_edited.jpg)

A human experience with online ease.

1. Consultation

Our 10 minute consultation is quick and casual. Help us understand your goals so we can put you on the right path.

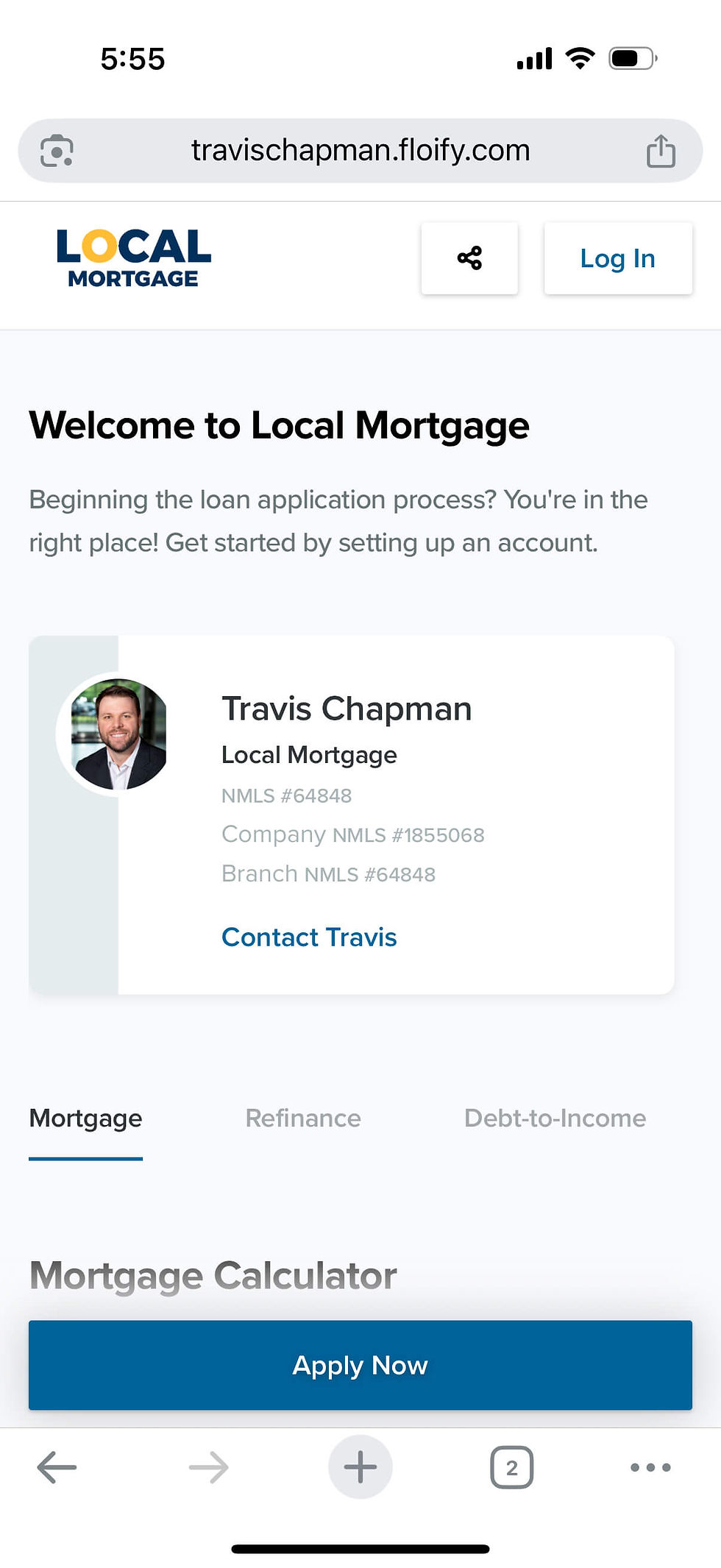

2. Application

Apply online or over the phone. We will give you a same day preapproval and get the loan process started.

3. Processing and Underwriting

Our loan process blends electronic document submission and automated updates with a human touch. We are always available to answer your questions.

4. Closing

Electronically sign some of the forms before closing, and then meet us at the closing attorney to sign the notarized documents.

.png)